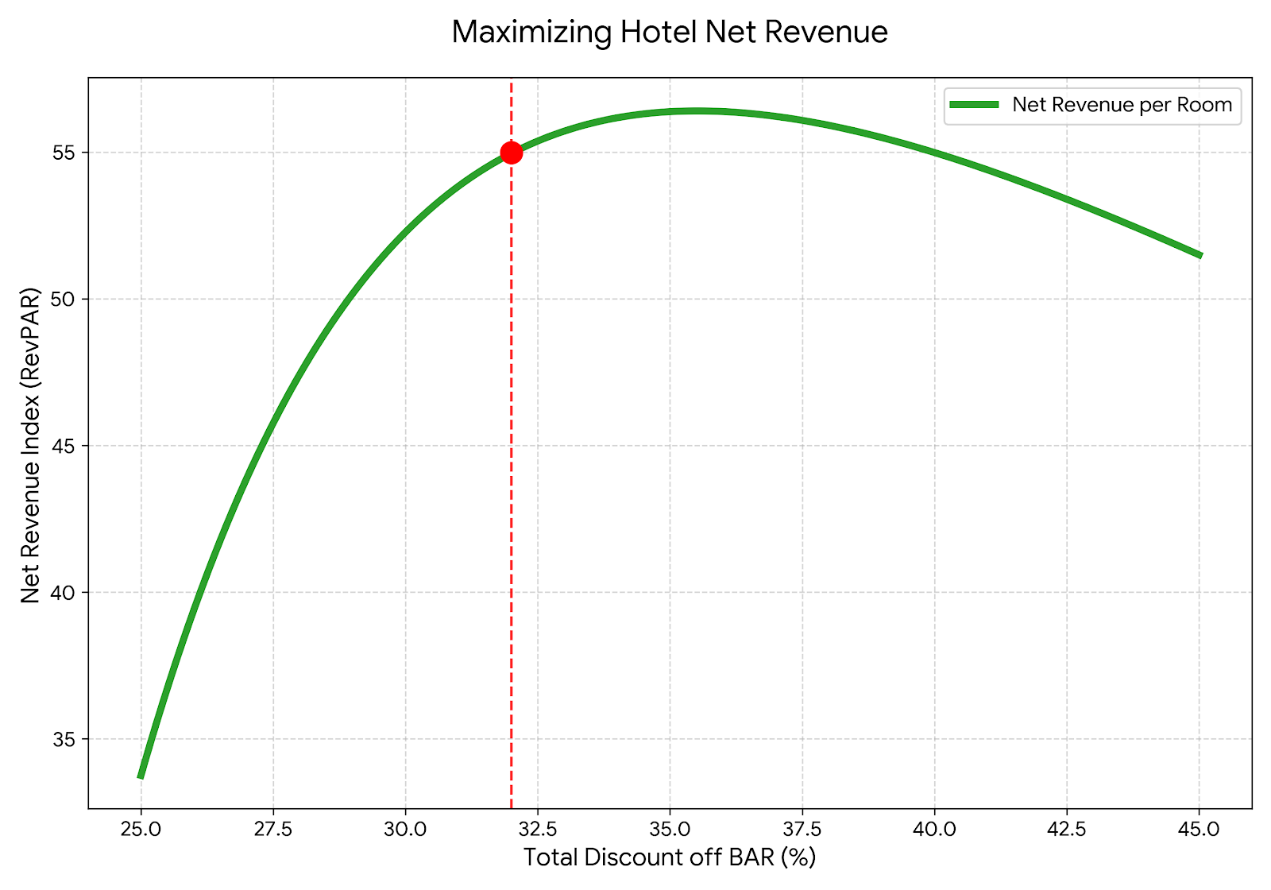

Net Revenue vs. % off BAR

Maximizing Your Revenue: Why the 32% Strategy Wins - Find the perfect price point that balances occupancy and profit margins.

Maximizing Your Revenue: Why the 32% Strategy Wins

Finding the perfect price point is a balancing act between filling rooms and protecting your profit margins. To help our partners succeed, we analyzed the relationship between discounts and total earnings. The data reveals a clear "Sweet Spot" at a 32% total discount off the Best Available Rate (BAR).

The Science of the "Sweet Spot"

When you offer a discount, two things happen simultaneously:

The Occupancy Surge: Initial discounts drive a rapid increase in bookings. By passing a portion of the savings directly to the traveler, your property becomes significantly more competitive in search results.

The Point of Diminishing Returns: As shown in the Occupancy vs. Discount graph, there is a physical and market limit to how many guests you can attract. Once you cross the 32% threshold, each additional percent you give away results in smaller and smaller gains in occupancy.

Why 32% is Your Most Profitable Choice

As highlighted in the Net Revenue graph, your total profit (RevPAR) follows a bell curve.

Under 32%: Your price is higher, but you have too many empty rooms. You are missing out on total revenue because your volume is too low.

Over 32%: You may fill more rooms, but you are discounting so deeply that your total take-home pay actually starts to drop. You are working harder for less money.

The Bottom Line: By choosing the 32% discount strategy, you maximize your net revenue. You fill your rooms at a high enough rate to trigger platform algorithms and build "buzz," while keeping your payout at the optimal level to ensure every booking contributes maximum value to your bottom line.